Our capital markets team has deep expertise on a broad range of issues, from just energy transition (JET), the political economy, policy and the macroeconomy. We help our clients think of the risks and opportunities that stem from the natural, political and economic environment. We also offer a subscription product that offers real-time updates and insights into South Africa’s capital market regulatory issues, state-owned enterprises and more.

The team has worked with counterparts at the highest level of government and the private sector, supporting global investors with investment strategy and innovation in fiscal strategies. We also work with capital markets providers to develop their services, producing expert reports for litigators and valuation reports for acquirers of assets.

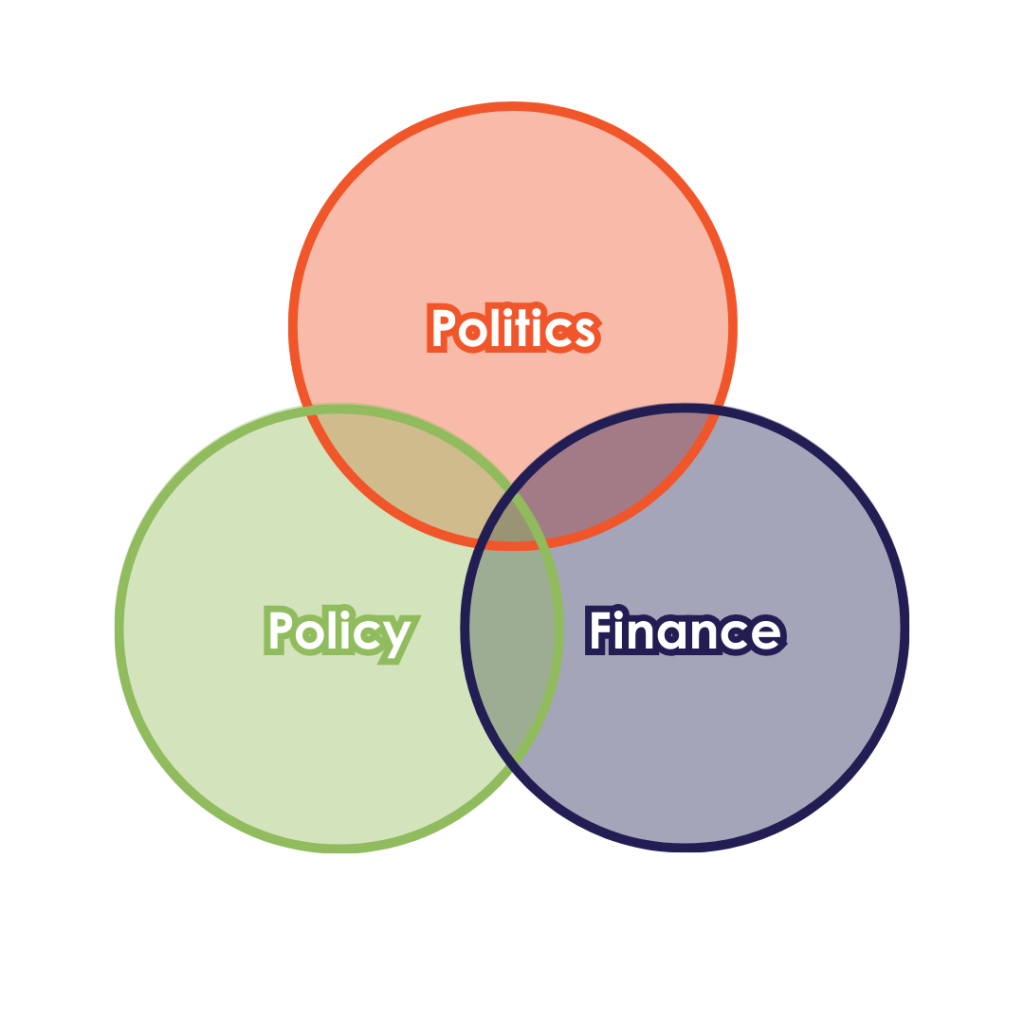

At Krutham, we focus on the critical intersection of Politics, Policy, and Finance—three interconnected themes that shape the economic landscape and influence strategic decision-making.

Peter Attard Montalto

Managing Director, Global Lead, Capital Markets, Political Economy and JET

Matthew le Cordeur

Research Manager, Just Energy Transition (JET)

Dr Cecilia Schultz

Senior Researcher, Social Economy

Thabani Madlala

Researcher, Policy and Political Economy Analyst

Nduduzo Langa

Politics Analyst

Zethu Diko

Infrastructure/JET Analyst

Our approach to Macro, Politics, and Reform Policy is about leveraging our expertise to deliver actionable insights and strategic support to our clients.

Krutham has significant expertise in working on just energy transition (JET) initiatives with clients in banking, asset management, development institutions, philanthropy, and policymakers. Krutham’s portfolio of projects includes partnerships with organisations such as the Impact Investing Institute, the Africa Climate Foundation, the Presidential Climate Commission, and the World Bank.

Our C-suite subscription product is our flagship strategic public affairs advisory offering – subscribed to by local and foreign corporates, banks and organised business.

The product includes regular Krutham research for clients, “fair use” access to our senior team and a pre-agreed list of research topics. Clients receive a bespoke set of reports normally in the form of a monthly depending on their business model (for example, our mining clients receive extensive insights on infrastructure policy, while our banking clients receive more comprehensive information on financial sector policy issues).

This product better serves our larger, more sophisticated clients, as it provides a flexible contracting relationship.

For clients who need focused insights into South Africa’s capital markets, we offer a basic capital markets subscription. This service provides essential updates and analysis, keeping clients informed about regulatory issues, state-owned enterprises, and other key factors that influence the capital markets.

We designed this service to provide senior executives in the banking sector with timely and relevant insights. Each client receives a customised monthly digest that delivers strategic content tailored to their needs and requests. We focus on proactive communication to ensure our clients stay ahead and have the critical information they need to make informed decisions and drive their organisations forward.

Clients who require on-demand expertise and immediate insights can benefit from this service. Our team of analysts provides flexible and responsive support, offering direct access for detailed discussions and tailored briefings. Clients can receive up to 20 hours per month of consultation time, which can be adjusted based on their needs during periods of heightened economic or regulatory activity. This service ensures that clients receive the guidance they need exactly when they need it, helping them navigate unforeseen challenges and capitalize on emerging opportunities.