Johannesburg – Market participants are generally pessimistic about the prospect of President Cyril Ramaphosa instituting growth-boosting reforms after the elections, an online election poll conducted last week by Intellidex has found.

Intellidex polled industry decision-makers from local and offshore asset managers and hedge funds, investment banks, institutional stockbrokers and wealth managers, with 46 respondents.

Key findings include:

- Markets believe that there is only a one-third chance of growth-boosting reform after the elections and that President Cyril Ramaphosa will survive until 2022 at least.

- There is a moderately high degree of confidence that a “mandate threshold” exists – a percentage of ANC votes that would provide Ramaphosa with a platform to institute reforms. However, the market is split on what this is and if it will be reached.

- Equally, market participants do believe that asset prices could enjoy a sustained rally should the ANC attain a certain level of votes but they don’t see this level actually being reached.

- People are roughly split down the middle on whether the ANC will keep Gauteng (as are we).

- Tito Mboweni and Pravin Gordhan are largely expected to retain their posts after the election.

- Overall, the market sees the national vote result as follows: 57.4% ANC; 20.7% DA and 11.4% EFF. The latter two are in line with Intellidex’s views but the ANC is looking a little high vs our view of closer to 55%.

Survey submissions were backloaded towards the end of the window and so we think there is a good number that incorporated the latest Institute of Race Relations poll.

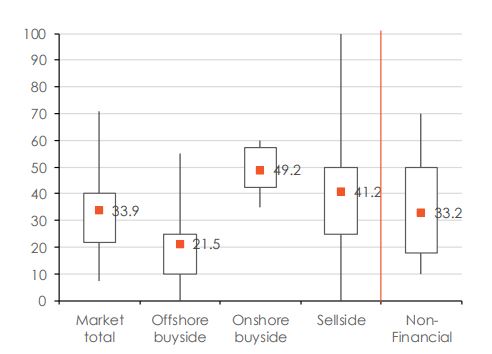

Figure 12: Probability of growth-boosting

reform occurring in the next 5-year

parliamentary term

Note: Reform was defined as that which would allow

growth to reach 3% by 2024.Source: Intellidex

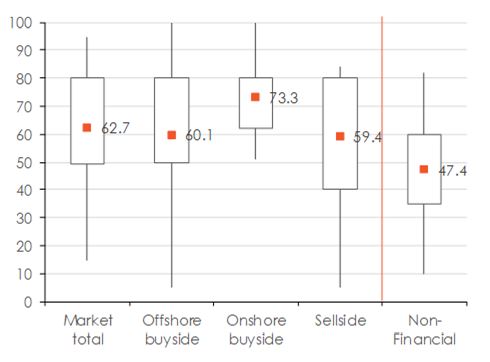

Level of ANC national vote share above

which SA asset prices will rally (%)

Note: Question defined a ‘moderate to strong rally’.

Source: Intellidex

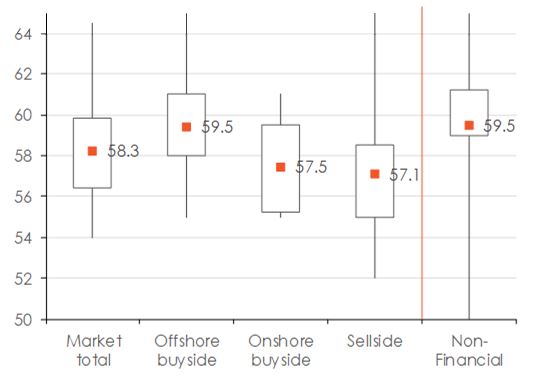

Market confidence that a

‘mandate threshold’ exists

Note: 0 = no confidence, 100 = total confidence that a mandate threshold exists. Source: Intellidex

The full survey report can be found here.

For more information, please contact Intellidex head of capital markets Peter Attard Montalto on email [email protected] or tel 011 083 5588.