Overview

This report aims to examine the findings on active traders and ESG from our Top Securities Brokers surveys in more detail. The results show that active traders rank ESG factors as being more important than we would have expected. This is perhaps a contradiction because active traders are thought to be interested in short-term trades, while ESG is a long-term issue.

We seek to understand how ESG factors into trade decisions for active traders. In the past three years, we have surveyed over 1,000 active traders to examine how they relate to sustainable investing. Following our 2023 survey, the aforementioned trends seem to be intensifying.

Our surveys show that:

- Active traders foresee a rising significance of ESG factors in the trading landscape over the next five years (Figure 4).

- Brokers face the challenge of bridging the gap between the traditional focus of active traders and the increasing importance of ESG factors in investing.

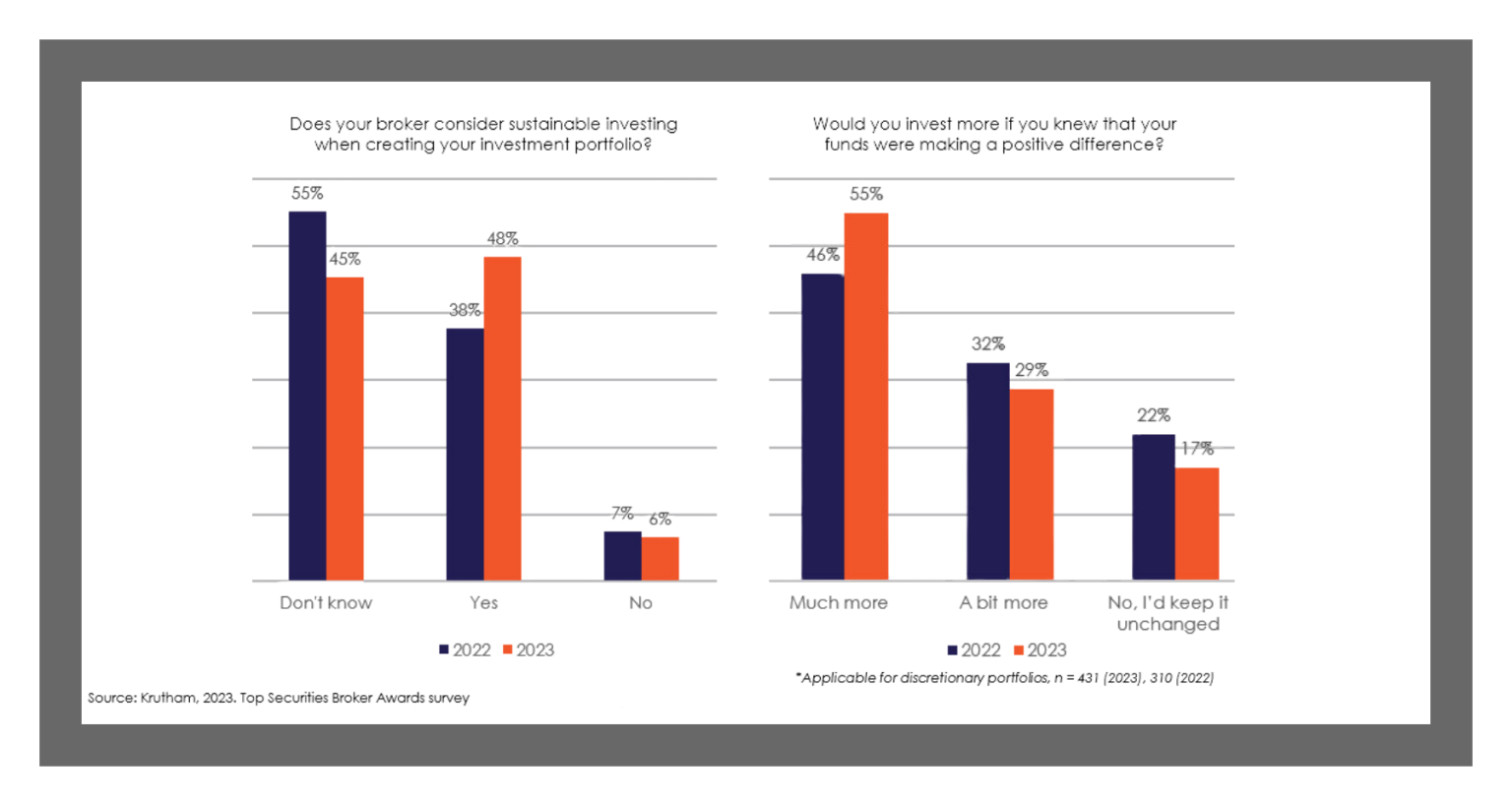

- Active traders would invest more if they knew their investment would positively contribute to sustainability (Figure 1).

- Insufficient or inaccurate research hinders the integration of ESG factors into both short-term and long-term investing by failing to reflect the sustainability levels of firms and economies accurately.

To better understand this situation, we undertook a series of interviews with active traders and the firms that serve them to unpack these findings.

We recommend that firms:

- Encourage the integration of ESG factors in short-term trading strategies. This could involve industry-wide initiatives, regulatory measures or market incentives to consider sustainability factors in shorter time horizons.

- Invest in improving the accuracy and availability of research related to the sustainability of firms and economies. Addressing the shortcomings in current research methodologies will positively influence the integration of ESG factors into short-term and long-term investment strategies.

- Establish mechanisms for continuous monitoring of market trends and trader behaviours. This includes regularly assessing the effectiveness of ESG integration initiatives and adapting strategies based on the evolving dynamics of the financial markets.

- Foster collaboration and knowledge-sharing platforms among market participants, research institutions and regulatory bodies. This can facilitate the exchange of best practices, research findings and insights, contributing to a more informed and sustainable investment ecosystem.

- Emphasise the importance of balancing profitability and sustainability. Develop educational initiatives for traders to raise awareness about the feasibility of coexistence between financial gains and ESG considerations.

Context

Sustainable investing has long been perceived as the domain of long-term investors with a strong moral compass. Its financial landscape prioritises environmental, social and governance (ESG) factors in investment decisions. In contrast, active traders are often stereotyped as solely concerned with short-term gains, prioritising returns rather than sustainability. However, a more nuanced narrative unfolds as we explore the insights gleaned from interviews with active traders and discussions with brokers. This report shares these insights, shedding light on the emerging synergy between active traders and sustainable investing.

We define active traders as market participants whose main source of income is from day-trading activities. While this definition revolves around investments of a short-term nature, active traders do engage in longer-term investments because of the lower risk.

Both active traders and brokers have raised concerns over the reliability of ESG social/impact scores. This appears to be a global issue as greenwashing and the subjectivity inherent in some measurement instruments are highlighted as drivers. As an example, the Human Rights Campaign (HRC) promotes the Corporate Equality Index (CEI), often seen as a company’s measure of its commitment to social awareness. In the second quarter, the HRC reported a 31% decline in the frequency with which companies mentioned these social metrics during their earnings calls (Martin Armstrong, 2023). This marks the most significant annual decrease and continues a five-quarter trend of declining mentions.

This is a step backwards as solutions ought to emphasise appropriate measures of progress by businesses and society on ESG factors instead of throwing the baby out with the bathwater. Sustainable investing is still in the structural adaptation phase (depending on the country and industry), meaning the issues highlighted may gradually disappear as improved structures to support ESG projects are adopted. Unbiased and accurate measures of ESG aid in better decision making. The question remains: to what extent does sustainable investing influence the trading attitudes of active traders?

In the following sections, we delve into survey findings and the insights gleaned from interviews conducted with active traders and securities brokers.

Traders and firms interpreting our survey findings

Investment decisions based on sustainable investing

Figure 1 shows that a growing portion of active traders would invest more in longer-term holdings if they knew their funds contributed to making a positive difference. Traders are also increasingly aware of their brokers’ sustainable investing practices.

Active traders say that they would invest much more if invested funds were being utilised for positive outcomes. A recurring theme for active traders is the need for clarity and transparency in ESG criteria, trends and investments. Traders emphasised the importance of transparency and accurate evaluations of ESG activities in reports.

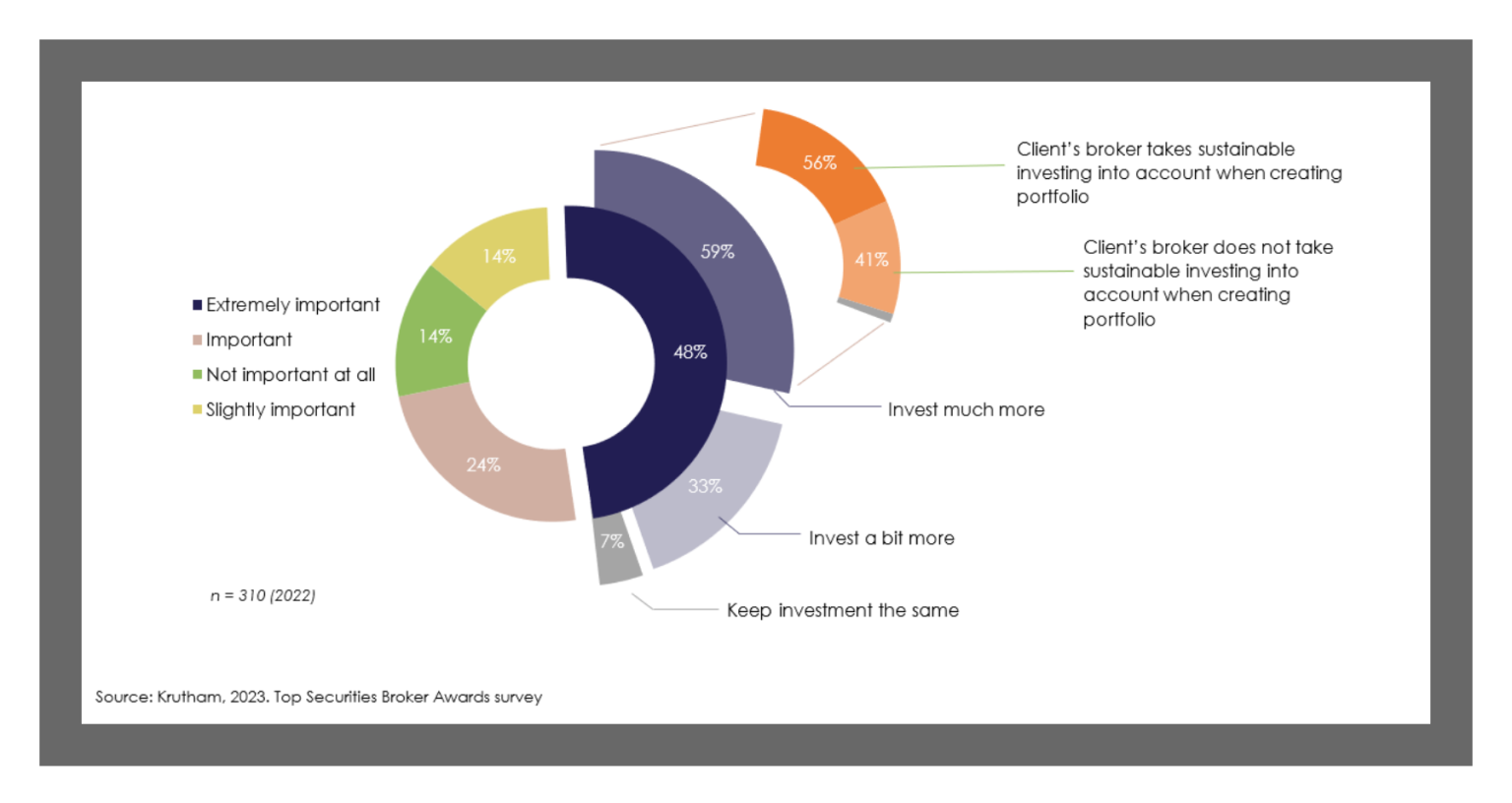

Figure 2 ESG considerations in investment decisions for active traders

Figure 2 shows that about half of the active traders believe sustainable investing is extremely or very important. Interestingly, 59% of these would invest much more if they knew their investment would have a positive impact. Importantly, the majority (56%) of those who would invest much more have a broker that already takes sustainable investing into account, while 41% do not.

During our round-table discussions, brokers noted that their relationship with active traders is not fully understood. They highlighted that because these investors trade in the secondary market, they do not directly influence companies’ sustainability practices. Rather, primary market investors, for example, have more influence during an initial public offering or special placement.

Furthermore, active traders’ investment decisions depend heavily on tracking short-term market movements, while ESG drivers have a longer-term effect and are reflected in price movements over the longer term. This does not allow for effective sustainability practices in short-term investments.

Quality of ESG research

Active traders we interviewed indicated that they rely on various sources for information, including third-party websites, official company websites and financial magazines in cases where information from brokers is insufficient. These traders exhibit a keen interest in the future and include sustainability factors in their assessments, recognising their importance in shaping long-term financial security. They expressed a preference for investing in clean and green energy companies, such as solar and wind, signalling a focus on reducing carbon reliance and promoting environmental sustainability.

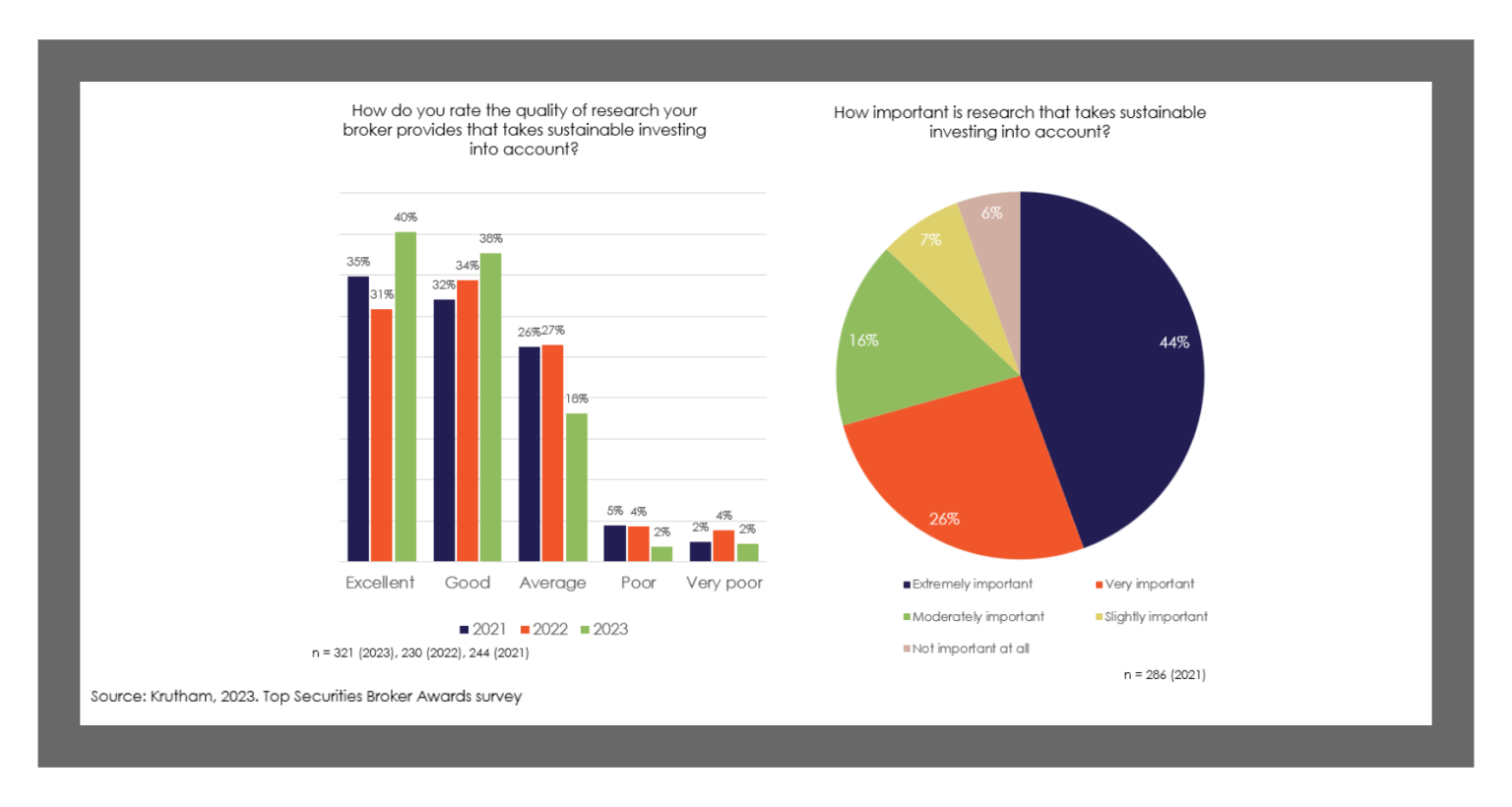

Figure 3 Active traders’ perceptions on the quality and importance of ESG research

Figure 3 is drawn from the survey and shows that active traders continue to appreciate the research quality by brokers. There is an upward trend highlighting growth in the quality of ESG research provided by brokers as the importance of sustainable investing gains momentum. The pie chart reflects the growing importance of ESG research to traders.

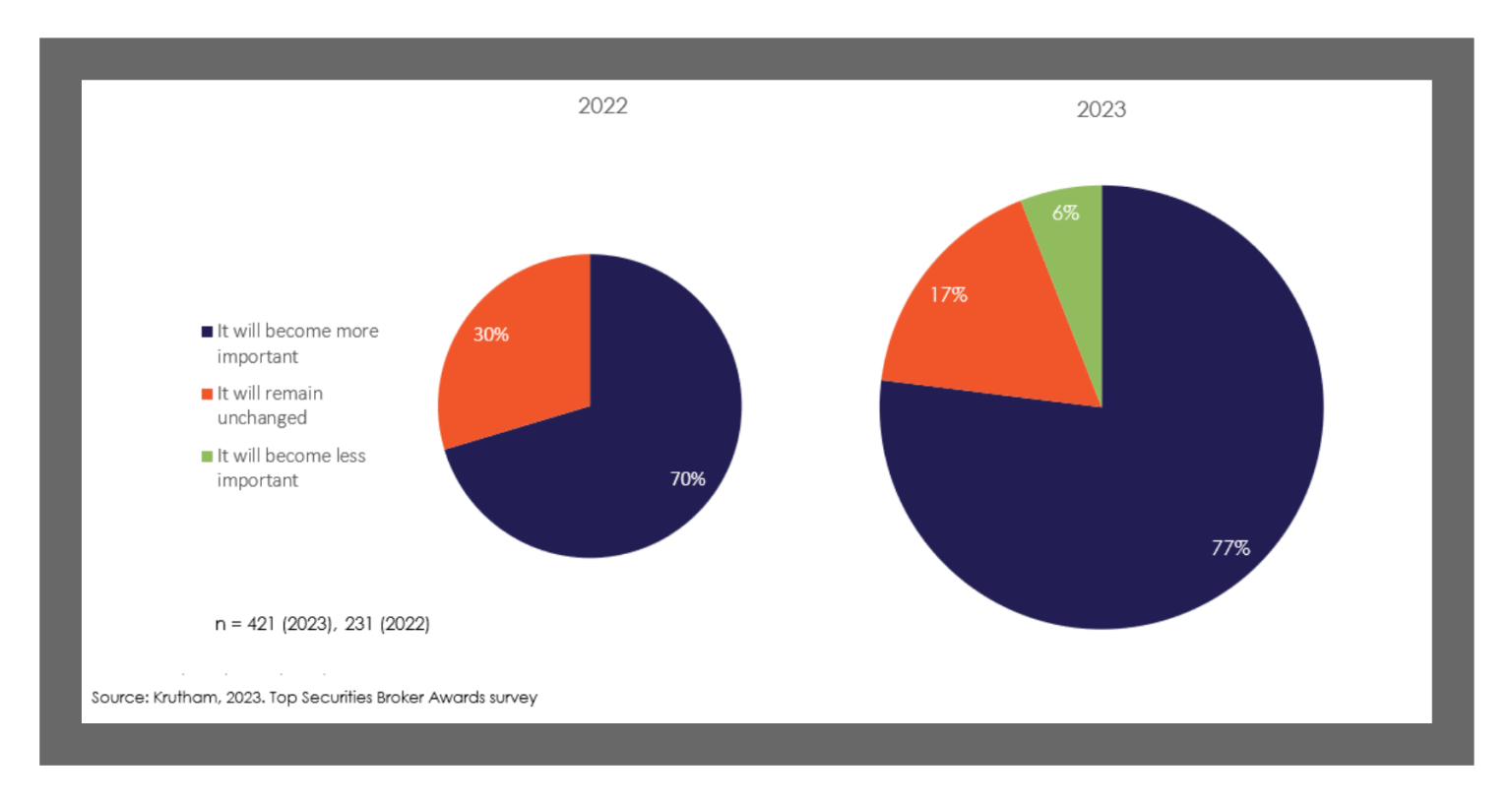

Figure 4 below shows that 77% (2022: 70%) of active traders believe sustainable investing will grow in importance and popularity in the years to come. However, there is growing scepticism, reflected by 6% of active traders who believe it will become less important in the next five years, whereas there were none last year.

Figure 4 How do you expect the role of sustainable investing to change in the next five years?

Concerns over greenwashing activities have reduced the reliability of some information available on ESG. Active traders see government policies as significant market influencers. Different arms are pushing legislation and incentives to combat misrepresentation regarding green activities by firms in the public and private domains. Encapsulating this mistrust, one active trader said: “I do not subscribe to ESG investing, not because I do not believe it has merit but rather because I believe there is too much manipulation and dishonesty involved.”

Profitability primacy vs ESG considerations

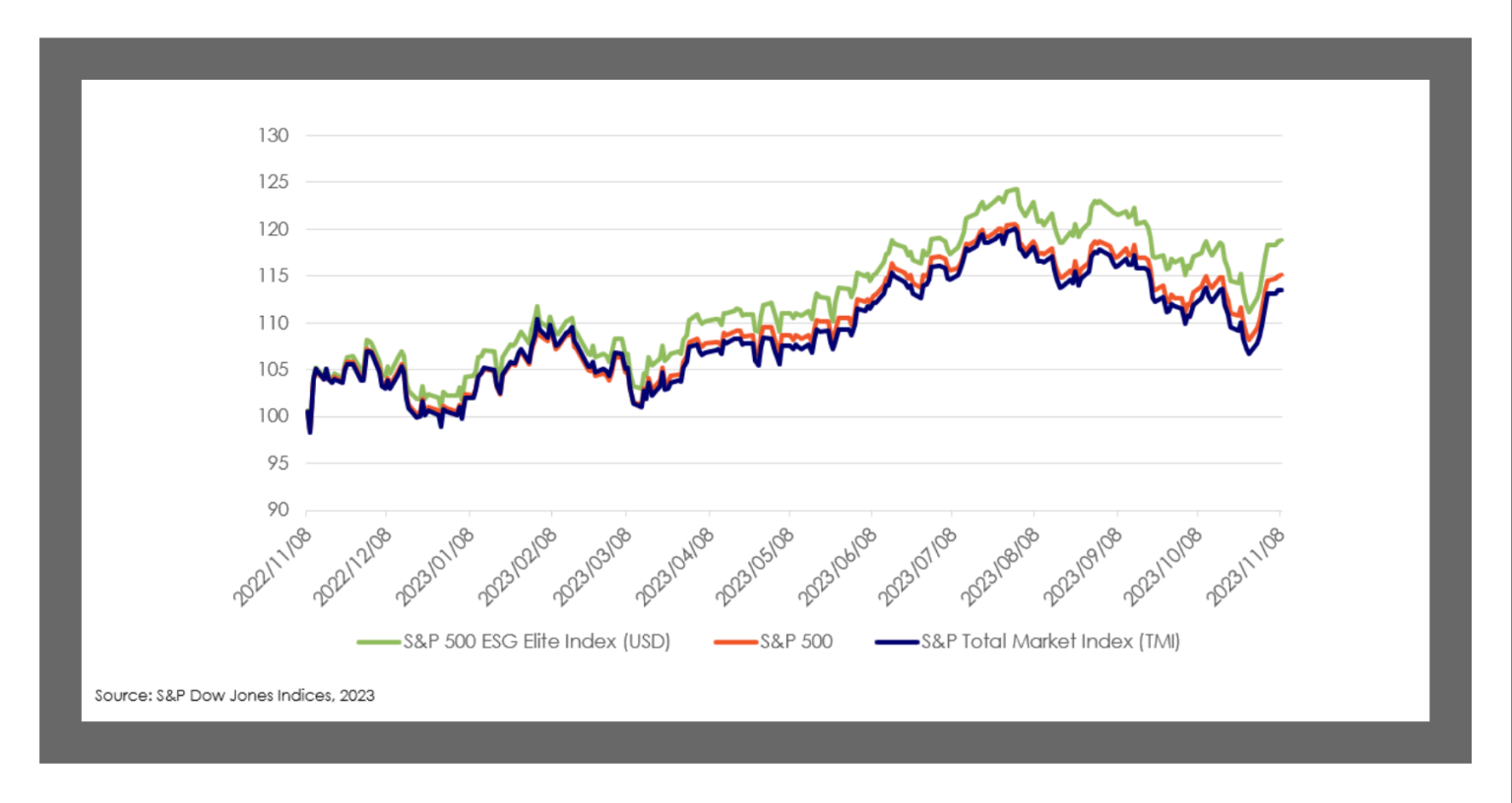

Information gathered from interviews shows that profitability remains the primary concern in making investment choices for active traders, with ESG factors not consistently taking precedence in their decisions. Traders highlighted the challenge of balancing personal financial goals with long-term sustainable investing objectives, particularly within the fast-paced trading environment. Should the market be concerned about possible trade-offs between profitability and ESG considerations? Interestingly, market data show that firms with high ESG scores tend to outperform the market (see Figure 5 below).

Figure 5 S&P 500 ESG index and S&P 500 index performance comparisons

In the last quarter of 2022, the S&P 500 ESG Elite index and S&P 500 mirrored each other’s performance, influenced by their similar industry weightings and the S&P 500’s focus on the top 500 US companies. However, by the end of the first quarter of 2023, the S&P 500 ESG index consistently outpaced the S&P 500 by an average of four points. Notably, the S&P 500 ESG index differs from its counterpart by tilting towards companies with higher ESG scores and exhibiting a greater concentration of technology securities than the S&P 500 index. Amid the challenges posed by the coronavirus pandemic, the technology sector emerged as a standout performer in the market over the past three years.

This finding significantly reduces potential trade-offs when choosing between profitability or ESG, given the latter’s robust market performance in recent years. Interviews with active traders reflect their desire for more instruments in the form of exchange-traded funds (ETFs), green swaps, contracts for difference (CFDs) and other derivatives that concentrate on sustainable industries, making it more accessible for traders to engage in sustainable investing.

The South African broker community indicated that demand for such instruments on the SA markets is still low for short-term activities but is growing for long-term investments. One broker said: “For day traders, sustainability and ESG considerations are typically not relevant, as day traders are more focused on short-term gains and volatility” (Krutham, 2023). Brokers also expressed some reservations about the momentum of sustainable investing in active trading, highlighting challenges of profitability and emphasising that ESG investments are better suited as a long-term game. While this may be the case, we are seeing a growing global trend as Asian and European markets continue to introduce short-term instruments that support sustainable investing.

Another example is the introduction of the option to trade ESG indices as CFDs ( City Index, 2023 ). At the time of writing, the JSE launched its carbon trading market which is expected to grow exponentially (JSE, 2023). This groundbreaking sustainability initiative will allow local participants to buy or sell carbon credits and renewable energy certificates held in either local or global registries – a market that suits active traders.

Implications and recommendations

As active traders and brokers interact with the ever-evolving financial landscape, the narrative surrounding sustainable investing is shifting. It is increasingly clear that some active traders consciously consider sustainability in their investment strategies, revealing a new alliance between fast-paced trading and long-term ethical investment. Market participants should encourage the integration of ESG factors in short-term trading strategies. This could involve industry-wide initiatives, regulatory measures or market incentives to prompt traders to consider sustainability factors easily in shorter time horizons.

While profitability remains a primary concern, there is a growing acknowledgement that profitability and sustainability can coexist. For brokers, the challenge lies in bridging the gap between active traders’ traditional focus and the emerging importance of ESG factors in investing. While certain brokers argue that traders do not directly influence the sustainability strategies of individual firms and, therefore, may not inherently need to engage in sustainable investing, support should be provided when they seek ESG considerations in their trade decisions.

As sustainability continues to gain momentum in finance, the question remains: can active traders harness their prowess to not only chase short-term gains but also contribute to a more sustainable and ethical future? The answer may be evolving before our eyes, creating a financial ecosystem that balances profit with purpose. As this synergy continues to develop, it could usher in an era where active traders and sustainable investing are no longer opposing forces, but rather complementary elements of a new financial paradigm.

Reference

BBC News, 2023. Coca-Cola and Nestle accused of misleading eco claims. https://www.bbc.com/news/business-67343893

City Index, 2023. CFDs on ESG companies https://www.cityindex.com/en-sg/thematic-indices/esg/

JSE, 2023. JSE collaborates with Xpansiv to launch voluntary carbon market to advance South Africa’s carbon credit capabilities (12/10/2023). https://www.jse.co.za/news/news/jse-collaborates-xpansiv-launch-voluntary-carbon-market-advance-south-africas-carbon

Krutham, 2023. Top Securities Broker Awards (2023, 2022, 2021) surveys

Krutham, 2023. Interviews with active traders

Krutham, 2023. Round-table discussion with South Africa’s securities brokers

Martin Armstrong (ArmstrongEconomics), 2023. Companies Back Away from CEI and ESG Social Scores https://www.armstrongeconomics.com/world-news/woke/companies-back-away-from-cei-and-esg-social-scores/

S&P Dow Jones Indices, 2023. S&P 500 and S&P 500 ESG Elite data https://www.spglobal.com/spdji/en/indices/esg/sp-500-esg-elite-index/#overview