Green, social and sustainability (GSS+) bonds are growing rapidly around the world. In 2023, Krutham assisted the Capital Markets Authority of Rwanda to develop a GSS+ bonds framework. This creates a long-term framework for the issuance of bonds that are attractive to international investors. Rwanda is a trailblazer in this area, with an innovative sustainability linked bond issued in 2023 which supported the Development Bank of Rwanda to both diversify its funding sources and achieve sustainability outcomes in the country.

The market for green, social and sustainability (GSS+) bonds has seen rapid growth in recent years as investors have become more aware of the systemic risks associated with climate, social and sustainability issues. Sustainable bond market principles, developed by the International Capital Markets Association (ICMA), have supported the development of the market through ensuring that these securities are credible, replicable and attractive to institutional investors. For green bonds, additional standards have been developed by the Climate Bonds Initiative (CBI). Compliance with ICMA and/or CBI standards must be independently verified, which adds an additional layer of costs to the issuance of these instruments. However, investors that purchase these instruments tend to differ from investors in vanilla instruments and therefore support the diversification of an exchange’s investor base.

Rwanda has developed an ambitious strategy to position itself as a regional financial centre and a GSS+ framework is a core component. This is evident in the establishment of the Kigali International Financial Centre (KIFC) ecosystem, supported by the activities undertaken by Rwanda Finance Limited (RFL) and Rwanda Development Board (RDB).

Krutham (then Intellidex) was commissioned by the World Bank to develop guidelines for the issuance of GSS+ instruments. This note outlines the market infrastructure, principles and best practices that informed the development of the guidelines.

Global funds allocated to ESG investments surpassed $41tn in 2022, and the sustainable debt market – which includes green, social, sustainability and sustainability-linked (GSS+) instruments – is forecast to grow to $15tn by 2025 from $4tn in 2020. The Global Sustainable Investment Alliance (GSIA) has categorised sustainable investment into seven core approaches, yet specific terminology for various investment approaches is often used interchangeably

Classification | Definition |

ESG integration | The systematic and explicit inclusion by investment managers of environmental, social and governance factors into financial analysis. |

Corporate engagement & shareholder action | Employing shareholder power to influence corporate behaviour, including through direct corporate engagement (ie communicating with senior management and/or boards of companies), filing or co-filing shareholder proposals, and proxy voting that is guided by comprehensive ESG guidelines. |

Norms-based screening | Screening of investments against minimum standards of business or issuer practice based on international norms such as those issued by the UN, ILO, OECD and NGOs (eg Transparency International). |

Negative/exclusionary screening | The exclusion from a fund or portfolio of certain sectors, companies, countries or other issuers based on activities considered not investable. Exclusion criteria (based on norms and values) can refer, for example, to product categories (eg weapons, tobacco), company practices (eg animal testing, violation of human rights, corruption) or controversies. |

Best-in-class/positive screening | Investment in sectors, companies or projects selected for positive ESG performance relative to industry peers, and that achieve a rating above a defined threshold. |

Sustainability-themed/ thematic investing | Investing in themes or assets specifically contributing to sustainable solutions – environmental and social – (eg sustainable agriculture, green buildings, lower carbon tilted portfolio, gender equity, diversity). |

Impact investing and community investing | Impact investing Community investingWhere capital is specifically directed to traditionally underserved individuals or communities, as well as financing that is provided to businesses with a clear social or environmental purpose. Some community investing is impact investing, but community investing is broader and considers other forms of investing and targeted lending activities. |

Source: Global Sustainable Investment Review 2020

The most common approach for sustainable finance in public markets is sustainability-themed investing which is facilitated via the issuance of green, social, and sustainability (GSS) bonds. These are use of proceeds instruments, meaning that the issuer raises the capital on the premise that the funds will be used solely to finance a particular green, social or sustainability initiative. Alternatively, issuers can raise funding with sustainability-linked bonds, which are general purpose instruments. These instruments are collectively referred to as sustainable bonds.

Use of these instruments necessitates both pre-issuance and post-issuance requirements to ensure that the proceeds are, in fact, used for the intended purpose. Ultimately, the often-stringent requirements have been designed to give the investor a level of surety that the issuer is not guilty of greenwashing, impact washing or SDG washing.

The use of sustainable debt instruments holds benefits for both issuers and investors. Issuers can raise additional funds and match maturity with the project life while improving investor diversification and enhancing issuer reputation. Additionally, the use of these instruments also tends to result in issuance generating high over-subscription rates due to high investor demand for these instruments. For investors, meanwhile, benefits include direct exposure to sustainable investing, market-rate returns plus positive social and/or environmental impact, as well as satisfying ESG requirements for sustainable investing mandates.

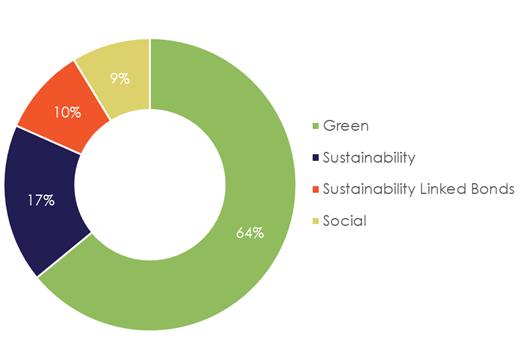

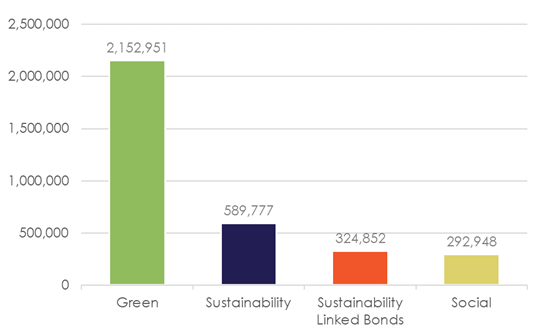

Considering these benefits, it is unsurprising that the sustainable bond market has seen rapid growth in recent years. As of June 2023, the year-to-date value of GSS+ bond issuance was $320.0bn, adding to cumulative issuance of $3.26tn since 2019. The bulk (64%) of issuance has been in green bonds, followed by sustainability bonds (17%), sustainability-linked bonds (10%) and social bonds (9%).

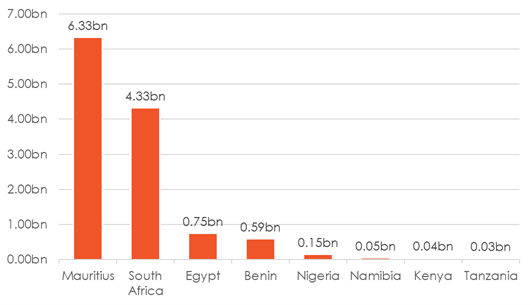

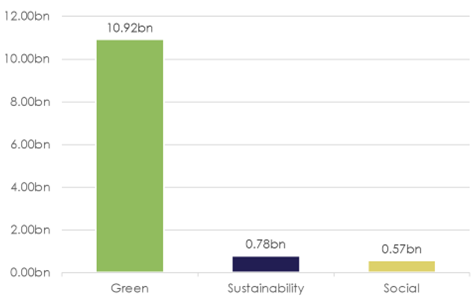

European issuers have dominated the market, followed by North America and Asia. Africa has been a small player in the sustainable bond market, with only eight countries having issued instruments, including Mauritius, South Africa, Egypt, Benin, Nigeria, Namibia, Kenya and Tanzania. As is the case with the global market, green bond issuance has dominated (89% of issuance), followed by sustainability bonds (6%) and social bonds (5%). By June 2023, there was no sustainability-linked bond issuance recorded for Africa on the ICMA database.

Annual sustainable bond issuance peaked at $1,04tn in 2021 before tapering off to $727.9bn in 2022. Despite the rampant growth in recent years, the sustainable bond market remains proportionally small relative to the ~$130tn global bond market. While new issuance slowed rapidly in 2022, partially as a result of the Ukraine crisis, issuance remains relatively robust and demand is expected to be underpinned by the urgent need to transition to low-carbon economies globally, not to mention as investor awareness of the need to bridge the funding gap for the global Sustainable Development Goals increases.

Sustainable bond issuance is expected to increase both in absolute and relative terms in 2023, with global new issuance expected to grow 36% to surpass $1tn, underpinned by diversification by issuers and themes. Outsized demand continues chasing limited supply and this presents a unique opportunity for markets that are strategically positioned to raise funding to achieve long-term sustainability objectives.

Our analysis suggests the need for an integrated approach for countries in East Africa to tap into this growing and important market. These include developing regional and domestic taxonomies and standardisation, improving disclosure, allowing for innovative fintech platforms and climate budget tagging (see Table 2).

Area of intervention | Details |

Regional and domestic taxonomies & standardisation | Develop a widely accepted regional sustainable finance taxonomy and guidelines to support environmentally sustainable investments in East Africa. · The confluence of different taxonomies will be vital to ensure consistency in climate-related disclosures and in improving the comparability of credit ratings across markets; · Regional standardisation of sustainable finance taxonomies would increase transparency, provide regulatory consistency, and ultimately reduce transaction costs for investors, thus, strengthening the role of private capital in the East African green bond market; · Without standardised regional guidelines and a quality control system, potential buyers of emerging market green bonds are forced to conduct additional due diligence to protect themselves from greenwashing, raising the transaction costs of purchasing green, social, sustainability, and sustainability-linked bonds; and · Several countries in Asia have already moved toward strengthening their green, social, sustainability and sustainability-linked bond guidelines and taxonomies, following a regional taxonomy publication. For instance, Malaysia and Indonesia published their taxonomies in 2022, while Thailand and Vietnam have produced draft frameworks that are closely aligned with regional peers. |

Tight disclosure requirements of sustainable finance investments | Impose tighter disclosure requirements of sustainable finance to help minimise greenwashing. · As global baseline and mandatory sustainability disclosure practices become more common in different regions, Rwanda and East Africa should enforce stricter disclosure standards; · In June 2023, the International Sustainability Standards Board (ISSB) issued its inaugural standards – International Financial Reporting Standards (IFRS) Sustainability Disclosure IFRS S1 and IFRS S2 which took effect in January 2024. The International Sustainability Standards provide global baseline sustainability disclosures for capital markets, which can be complemented by regional regulations. The standards create a common language for disclosing the impact of climate-related risks and opportunities on a company’s prospects, thus, building trust and confidence in company disclosures about sustainability to inform investment decisions; and · Several governments, including the United Kingdom, Canada, Singapore, Japan, New Zealand, Australia and Nigeria, are planning to adopt ISSB. |

Fintech investment platforms | Develop low-cost online investment platforms. · Several fintech investment platforms have emerged both in emerging and developed markets that enable consumers to screen assets and invest funds in green, social, sustainability and sustainability-linked bonds; · These platforms could help mobilise savings and enhance the development of local capital markets; and · The platforms offer a convenient way to trade currencies, stocks, commodities, bonds and other instruments. And since these platforms can be accessed from any device at any time, they could open new opportunities for people who don’t have ready access to traditional financial institutions. This will attract domestic retail investors and domestic private pension schemes. |

Climate Budget Tagging | Implementation of the Climate Budget Tagging (CBT) tool. · As demand for green, social, sustainability and sustainability-linked bond instruments increases, the Rwandan government should consider issuing sovereign green, social, sustainability and sustainability-linked bonds. Local authorities should implement the CBT to assist in identifying, classifying, weighting, and marking climate-relevant expenditures in their budget system, enabling the estimation, monitoring and tracking of those expenditures; · The CBT aims to improve the management of the response to climate change. It includes the process of attaching a climate budget marker, such as a tag or account code to budget lines or groups of budget lines; · Implementing CBT can have a wide range of benefits, such as assisting in resource mobilisation and minimising greenwashing. For example, Indonesia’s CBT data aided in the issuing of green bonds, including the world’s first sovereign green sukuk bond, raising $1.25bn in 2018; and · Bangladesh, Ghana, Kenya, Nepal, Pakistan, and the Philippines are among the other countries developing and implementing CBT. |

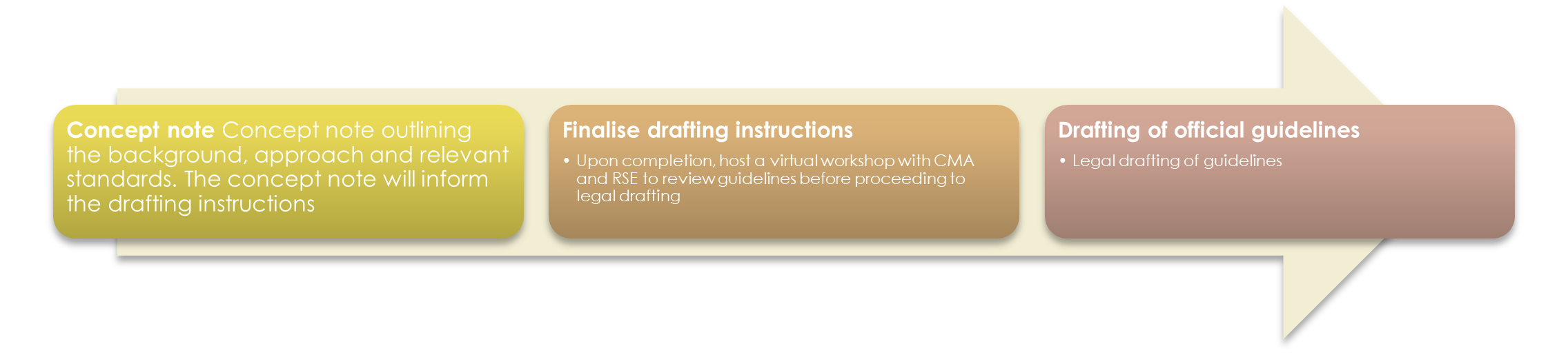

Regulatory guidelines are an important part of the solution. To assist in developing appropriate GSS+ guidelines for Rwanda, we took a structured three-step approach to developing regulatory guidelines.

This project had three primary elements:

All investors highlighted the need to introduce a globally consistent framework. Most foreign investors and asset managers indicated that their investment universe is defined by benchmark indices for their asset class and country selection, particularly, the JP Morgan Government Bond Index-Emerging Markets (GBI-EM). GBI-EM consists of regularly traded, fixed-rate, domestic currency government bonds which international investors can readily access. The index excludes countries where local market investing is subject to explicit capital controls, but eligibility consideration does not factor in regulatory/tax hurdles.

Investors emphasised the following key GBI-EM index criteria to be considered for inclusion:

JP Morgan’s GBI-EM eligibility for local currency issues is determined using the following criteria:

From understanding the appetite for the market, we followed an approach to develop a detailed concept note providing the background approach and standards, followed by drafting instructions which converted the concept note into more detail, and then finally the production of guidelines.

The guidelines themselves contained 15 Articles, covering all the necessary components of the framework.

Section | Details |

PRELIMINARY | |

Article 1: Purpose | Explained the purpose of the regulations |

Article 2: Definitions | Definitions |

Article 3: Scope | How these guidelines interface with other regulatory instruments, particularly capital market regulations |

CHAPTER 1: CONDITIONS AND REPORTING FOR THE ISSUER | |

Article 4: Conditions and process of issuance for the issuer | The conditions that need to be met together with the process |

Article 5: Sustainable Bond Memorandum | Ensures appropriate disclosure |

Article 6: Disclosure and interim reporting obligations | Requires disclosure and interim report |

Article 7: Maturity and buy-back | Outlines maturity and buy-back rules |

CHAPTER 2: DETAILS OF THE SUSTAINABLE BONDS | |

Article 8: Use and management of proceeds for a use of proceeds bond | Sets out how proceeds for these bonds should be used |

Article 9: Selection of KPIs and calibration of SPTs for general purpose bonds | Notes different KPIs |

Article 10: Characteristics of the general purpose instrument | Explains the characteristics of general purpose instruments |

CHAPTER 3: PROCEDURES AND OBLIGATIONS OF THE AUTHORITY | |

Article 11: Procedure for issuance of a sustainable bond | Notes the procedures ahead of issuing sustainable bonds |

Article 12: Breach of sustainable bond requirements by an issuer | Highlights breach provisions |

Article 13: Suspension of a sustainable bond | Sets out suspension requirements |

CHAPTER 4: INDEPENDENT VERIFIER | |

Article 14: Eligibility as an independent verifier | Outlines eligibility requirements for an independent verifier |

Article 15: Commencement |

The regulatory guidelines were designed to provide a long-term framework for the issuance of GSS+ bonds.

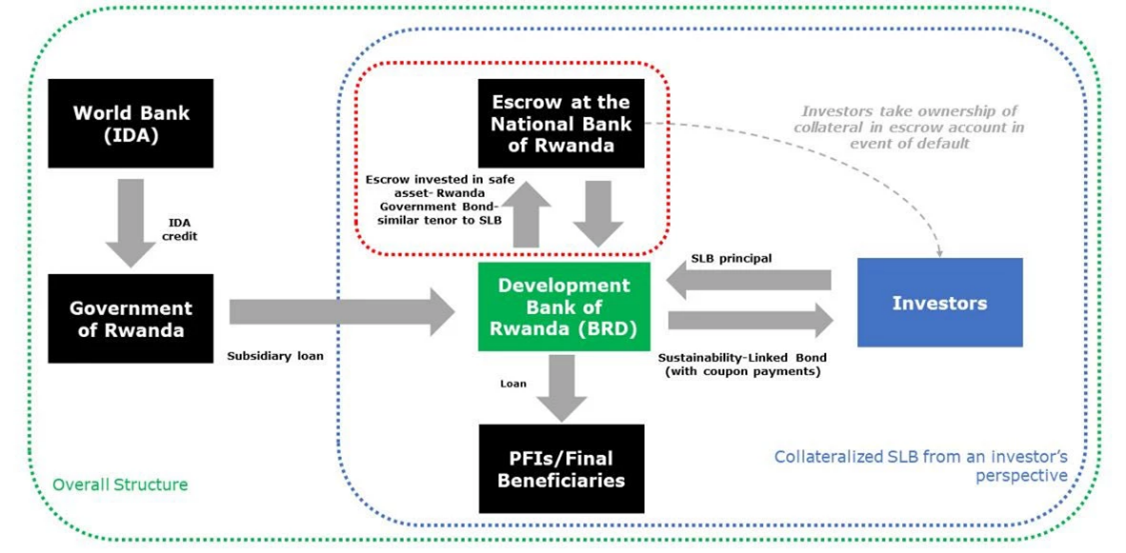

While Krutham was only part of the process by assisting with the regulatory framework and did not advise on the bond issuance, understanding the Rwanda Sustainability-Linked Bond is an excellent example of innovative finance. Perhaps the most striking feature of the Rwanda Sustainability-Linked Bond is how innovative the credit enhancement mechanism is. Instead of a typical approach of a line of credit (for $40m), the government of Rwanda used $10m of IDA funds, made possible by the World Bank lending operation, to collateralise the bond, effectively reducing the risk for investors and lowering the cost of borrowing. This initial issuance begins with a RWF150bn billion ($124m) overall issuance programme.

The SLB opened the path for the Development Bank of Rwanda (BRD) to diversify its funding sources. It was also oversubscribed, drawing demand from 100+ different investors. The $10m IDA financed credit enhanced issuance enabled the institution to raise three times the amount in funding from capital markets. This serves as an important signal for other potential issuers and contributes to building capacity in the domestic capital market. The bond raises funding for the BRD in local currency, which reduces risks due to foreign exchange fluctuations.

The market for GSS+ bonds is growing rapidly. It creates opportunities for government, development banks and financial institutions to create new innovative funding sources to support growth.

A key part of the process is to introduce an appropriate regulatory framework. Krutham assisted the Capital Markets Authority of Rwanda on this important component. This will support new issuances of the bond and help Rwanda establish itself as a financial hub for Africa.