The government has had a torrid time in the past five years trying to turn the infrastructure tanker. While there has been some change, it’s been slow. The Infrastructure Fund is a positive example but it too encountered the long-standing problems of project ill-preparedness or a lack of bankability. The investment and infrastructure office in the presidency clearly hasn’t delivered on its mandate to decisively shift infrastructure to a new level.

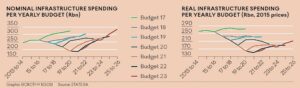

The data on infrastructure is instructive. The government has trumpeted that spending has turned around in recent years. We have seen nominal spending of R255bn in the current fiscal year, 36% above (pre-Covid-19) 2019/2020. That is after it dropped about 20% from 2015/2016 to 2020/2021. Spending is now back above that level, which sounds like a good news story. But there are some issues, as seen in the accompanying graphs.

The “price” (or deflator) of infrastructure spending as per Stats SA data is actually 38% higher in the past fiscal year compared with 2015/2016. However, in real terms, infrastructure spending is actually about 30% lower. Real terms is what counts — the number of infrastructure projects (bridges, pipes and roads) that are completed is all that matters.

In real terms, spending is expected to even be a touch lower in the coming fiscal year as the National Treasury pulls back on underspending. While it is expected to grow further in 2025/2026 it is still likely to be about 20% lower than in 2015/2016 in real terms.

Much of the 2025/2026 increase is down to a focus on energy investments including solar panels on government buildings and social housing. That’s positive, but strip out energy and look at “other” infrastructure, and the picture is quite a lot worse, with a much more gradual rise in real infrastructure spending.

Infrastructure spending may well be turning a corner, but it’s from a far lower base than many people realise.

Tease mining

There are many related gems in the latest GDP data for the fourth quarter. Investment, it turns out, is a rather more complex story than the headline 4.7% real growth of fixed capital investment in 2022. Even though that was the highest since 2013, the total amount of investment is still about 17% lower than that year. Transport and machinery were the main supporting pillars.

However, all is not well below the surface. A question I like to tease the mining sector with is, “is SA actually a mining country?”

The GDP data shows that mining exploration was down 9.7% in real terms last year — while there is supposed to be a boom in strategic minerals for the just energy transition, a global terms-of-trade cycle, and demand for coal amid the fallout from the war in Ukraine.

And it gets worse: mining exploration spend in real terms has shrunk sharply in eight of the past 10 years. The amount SA is spending on mining exploration now is just 28% of that a decade ago. That is bonkers, and it will define the shape of the industry for many years.

The reasons are well understood and often rehearsed in these pages, but it boils down to mining simply not being a priority — and that won’t change until there’s a shift in leadership in that area of government; one that understands the complexities of a modern mining economy and, in particular, the security issues now at play. There is little point talking about beneficiation when so little stuff is coming out of the ground to beneficiate.

Research & development (R&D) spending by the private sector (again in real terms) is down 4.8% on the previous year, making it six years of contraction. That same measure averaged 10.6% growth annually from 2002-2007 before the global financial crisis and the Zuma administration. Now, the same amount is being spent in real terms as in the late 1990s, or half as much as the recent peak of spending in 2016.

Mining exploration

The question then, is where will future total factor productivity (TFP) come from if R&D spending is falling, infrastructure spending is sluggish and exploration is weak (not to mention many other factors)? TFP growth for the coming 20 years is built into the investment choices to be made in the next few years. Looking past the Covid-19 wobble, TFP has been shrinking since at least 2016.

It is an issue that’s apparently being ignored. If SA substantively solves load-shedding in the next few years (which is possible though certainly not easy) — and investment in new energy sources and associated matters such as transmission increases — will TFP rise? Perhaps to some extent initially, but we may well encounter other limiting factors such as the lack of mining exploration in recent years and the lack of infrastructure investment. Then there is the skilled immigration visa issue and education; not to mention the train smash that is Transnet.

The takeaway perhaps is this: SA can see something of a small boom between, say, 2025 and 2030 if load-shedding is solved, but will quickly encounter other limiting factors that needs to be solved now — the logistics industry and its reform, visas, a conducive environment for mining exploration and nonenergy infrastructure investments.

There is always something that needs a solution and reform in the short term.

• Attard Montalto leads on political economy, markets and the just energy transition at Intellidex, an SA research-led consulting company. This article first appeared in Business Day.